Fiscal

Service Overview

Purchasing Card Transaction Approval

Cost Centers will submit Purchasing Card transactions in Workday with all supporting documentation in an Expense Report(ER#). The BSC will review the ER# and approve if complete.

Travel

Cost Centers will submit pre-travel authorization in a Workday Spend Authorization(SA#) and will arrange all travel. The BSC will review the SA# for compliance. After trip completion, the Cost Center will submit a travel reimbursement in Workday with an Expense Report(ER#) for BSC approval.

Non-Travel Reimbursements

Cost Center faculty or staff will submit an Expense Report(ER#) in Workday with the supporting documentation and a business purpose. The BSC will review for compliance and approve.

Workday serves as a single destination for most of your HR, payroll, finance and supply chain requests.

To access Workday, visit workday.osu.edu.

For job aids specific to financial transactions, travel, supply chain and HR please go to admin.resources.osu.edu/workday

Miscellaneous payment requests can be used in unique circumstances when a payment must be made to an entity which is not an Ohio State supplier. Miscellaneous payment requests can be used in the following situations:

- Affiliate payment

- Charitable donation

- Conference registration (when PCard or reimbursement is not an option)

- Employee assistance (non-payroll, non-supplier taxable payments to employees)

- Honorarium

- Human subject

- Petty cash / human subject advance

- Refund

- Relocation payment

- Royalties and commissions

- Stipend

- Student awards

- Student organization payments

- Wire transfers

*If a person/organization already has a supplier ID then you must use a non-PO invoice request (SIR)

How to initiate a miscellaneous payment:

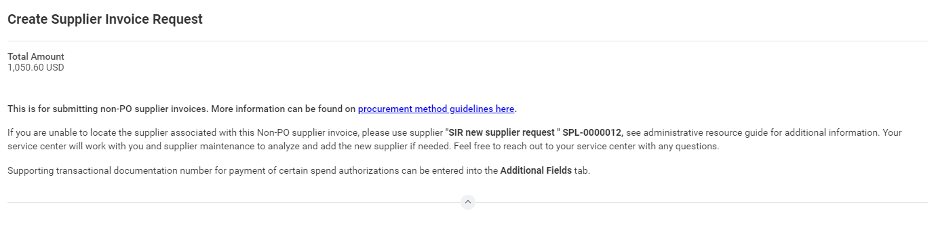

The Supplier Invoice Request (SIR) Process is used in limited circumstances to pay supplier invoices for purchases that could not be made via purchase order (non-PO). It is managed by the Accounts Payable (AP) department. We use Workday to process and pay supplier invoices.

The SIR Process is also used if paying for an NRA and/or via wire where a miscellaneous payment or expense reimbursement would otherwise be used.

Examples of payments that can be made by Supplier Invoice Request include:

- Buck-ID Merchant Reimbursements

- Commission Payments – External Ticket Sales

- Conference Registration

- Dues and Memberships

- Foreign Payments

- Legal Services

- Library Acquisitions

- Medical Services/Insurance for Student Athletes

- Utilities – Energy and Non-Energy

How to initiate a Supplier Invoice Request (SIR):

According to OSU Purchasing Policy, only the president, senior vice president for business and finance, and individuals given signature authority annually through delegations are authorized to sign contracts on behalf of the university. Failure to ensure that the appropriate signature authority is obtained or executing a contract on behalf of the university without requisite authority may result in personal liability to any employee who executed the contract or was involved in the transaction.

Additionally, PCard purchases in special spend categories must be reviewed and approved by Purchasing or the Office of Legal Affairs, as applicable, prior to purchase.

PCard Terms and conditions submission form

Expedited Review Process

The following guide and FAQ should be used to understand when an expedited review process is available for approving certain terms and conditions contained within procurement agreements.

Using this method when applicable allows for quicker execution of contracts for faculty and staff and reduction of workload for Central Procurement and Office of Legal Affairs.

When the Expedited Review Process is Available

Suppliers may request a signature from The Ohio State University via an agreement, Statement of Work (SOW), Memorandum of Understanding (MOU), or Terms & Conditions when making a purchase.

If ALL of the following criteria are met, an expedited review process is available for obtaining signature:

- The purchase is less than $25,000

- The purchase falls within at least one of the following Spend Categories

- SC10663 – Education and Training – Conference Registration

- SC10671 – Food – Restaurants and Catering (only restaurants and caterers outside of Columbus and Internal Suppliers)

- SC10726 – Meeting Facilities Rental (if a hotel rental, only non-Columbus hotels and Internal Suppliers)

- SC10736 – Hotels and Lodging (only lodging outside of Columbus and Internal Suppliers)

- SC10737 – Entertainment Services (only entertainment services outside of Columbus)

- Supplier agrees to attach Disclaimer Language to the agreement

- Senior Fiscal Officer (SFO) has reviewed and signed the agreement

- If the purchase is made under a Grant, and any part of the purchase is not allowable under the Grant, related expenses are the responsibility of the Unit. Contact the Grants Shared Service Center with questions.

If all of these criteria are NOT met, please refer to the following resources:

- Procurement Agreements under $500,000 – Procurement Agreements Management

- Procurement Agreements over $500,000 – OnBase Contract Management

When airfare is being charged to a federal contract or grant, travelers must be in compliance with the Fly America Act. Compliance is signified by the United States Flag Air Carrier’s code which must be noted as part of the flight number on the airline ticket or passenger receipt. Each airline has a two letter alpha code. For example, United Airlines has a code of “UA”. On an airline ticket or passenger receipt, this two digit code is designated just to the left of the flight number (e.g. UA 10). From the list of U.S. Flag Air Carriers below, you will be able to compare airline codes on the ticket with those on the list and ascertain whether or not the flight is on a U.S. Flag Air Carrier.

- Airtran Airways (FL)

- Alaska Airlines (AS)

- American Airlines (AA)

- Delta Airlines (DL)

- Frontier Airlines (F9)

- Hawaiian Airlines (HA)

- Southwest Airlines (WN)

- Spirit Airlines (NK)

- United Airlines (UA)

The only allowable exception is if travel is supported by federal funds, travelers may choose to fly European Union airlines as long as they touch down in an EU country. A list of current member countries of the European Union is available at the Europa web site.

Please note: Travelers whose funding is coming from the U.S. Department of Defense (DOD) are not permitted to take advantage of Open Sky Agreements.

Requests for reasonable accommodation for health or religious reasons must be requested and approved prior to Ohio State Business Travel/Purchases and should be documented on the Spend Authorization/Expense Report in Workday. All health-specific information which could violate the Protected Health Information and HIPAA Policy must be redacted.

Health-Related Reasonable Accommodations: For requests, please contact the Ohio State ADA Coordinator's Office.

Religious Accommodation Requests: Please contact your HR Employee and Labor Relations (ELR) representative. To find your representative, you can go here.

When is a Supplier Invoice Request (SIR) used?

- All payments to NRA individuals non-purchase order related including travel reimbursements, honoraria, external reviewers, and article referees.

- All wire payments to individuals to foreign bank accounts for travel reimbursements/honoraria, NRA, or US Citizens.

- Payments to US citizens for small dollar onetime services by individuals (external reviewers, referee payments, musicians, article reviewers)

- Dues and memberships when a PCard cannot be used.

- Conference Registration when a PCard cannot be used.

- Honoraria payments to US citizens when an existing active supplier ID is in Workday.

How do I request a new supplier ID (SPL#)?

Requesting a new supplier in Workday is processed concurrently with submitting the travel reimbursement/payment on a Supplier Invoice Request – Payment Request/Non-PO (SIR).

- Supplier forms and documentation must be attached. Please refer to Ohio State Supplier Maintenance.

- All travel receipts must be attached to the SIR.

- Backup documentation for honoraria payments such as a flyer/announcement

- Invoice for article reviewers or equivalent.

Please search in Workday to ensure there is not an existing supplier ID (SPL). If there is not an existing SPL, follow the below steps.

- For NRA individuals (non-resident alien), please refer to the NRA Checklist for additional forms that may be needed when they travel to the US

- The below are links to forms which may be needed depending on the scenario on the AP checklist:

- Ohio State Supplier Maintenance Form (Updated 2/2025)

- Foreign Entity W-8BEN Form

- If this is for a onetime small dollar service (referee payments/external evaluators, author reviews/royalty payments for an NRA only) the OPERS form is required.

- The OPERS form is NOT needed for NRA honoraria payments.

- For Ohio State, the "employer code" is 1641, but the employer contact would be the name and phone number of the contact as set up with the vendor.

- The OPERS form requires a wet signature. The others can be obtained via Docusign.

- The below are links to forms which may be needed depending on the scenario on the AP checklist:

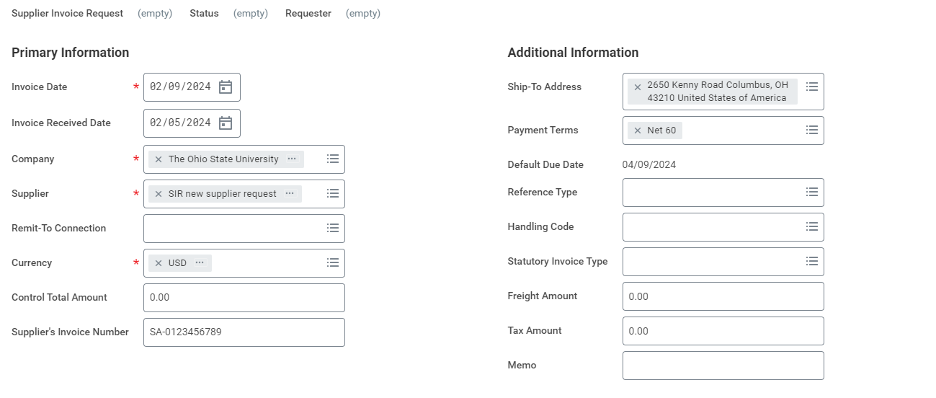

- A Cost Center Representative will create a Supplier Invoice Request in Workday (SIR) for the travel reimbursement and/or payment and attach all required supplier request forms. For the supplier in the SIR, SPL-0000012 “SIR new supplier request” will be used.

- A service center representative will complete the Supplier Request in Workday.

- Once a supplier number (SPL#) is created the service center fiscal associate update the supplier in the SIR with the SPL# and will proceed with the approvals.

Changing/Updating an Active Supplier

The unit will send an email with the changes (address etc.) to bf-prsm-webform@osu.edu

SIR Submission Example

Refer to the job aid on the ARC for detailed instructions:

- If there is an approved supplier (SPL) you will enter/select that SPL# in the “Supplier”.

- If there is no invoice number and is for travel, please list the SA# for the guest.

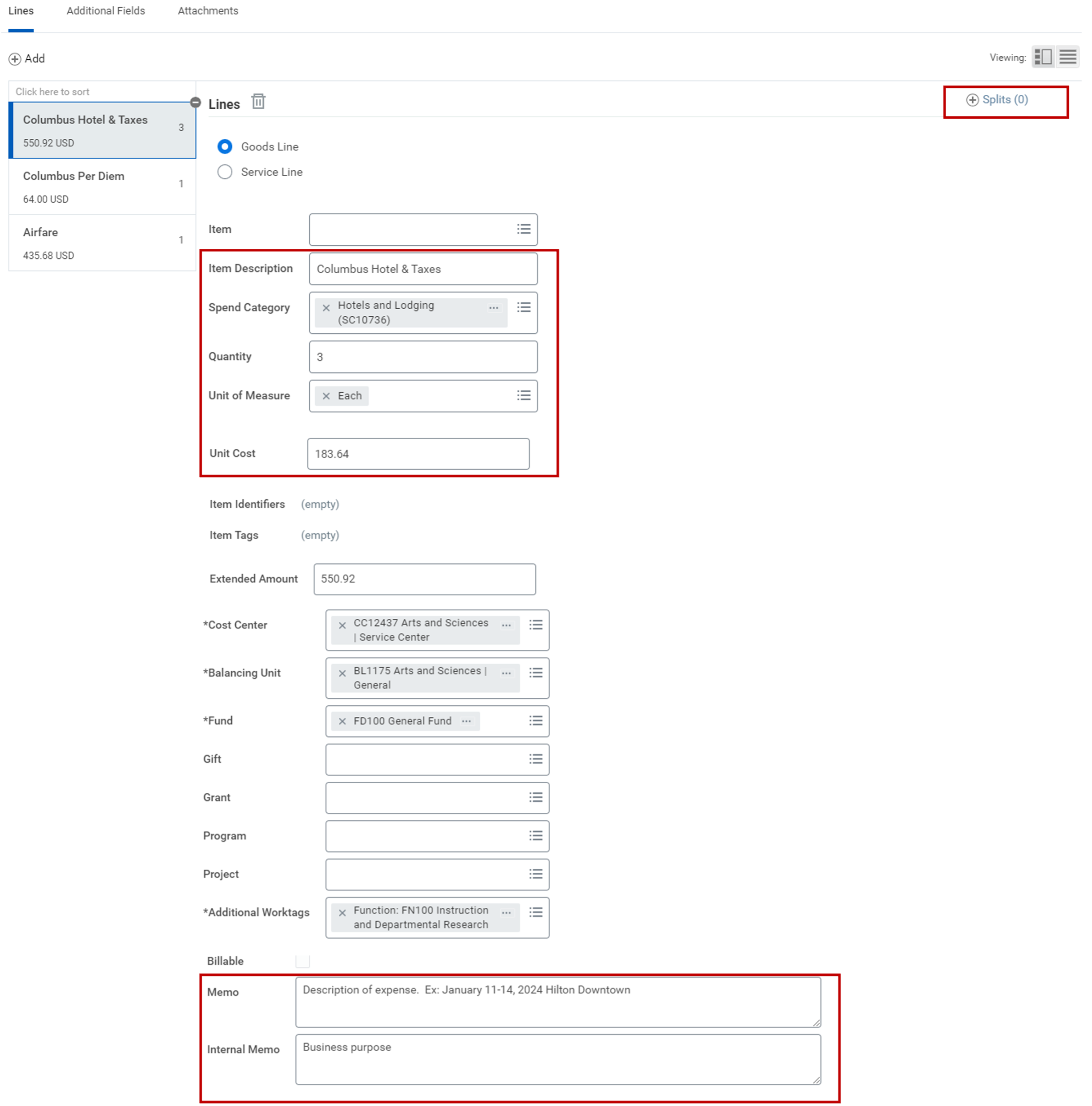

SIR Line Entries

- For travel reimbursements, please add an “Item Description” in conjunction with the spend categories.

- Honoraria and travel expenses can be submitted together on one SIR as separate lines.

- Please complete the “Memo” and “Internal Memo” sections.

- Funding can be split on each line.

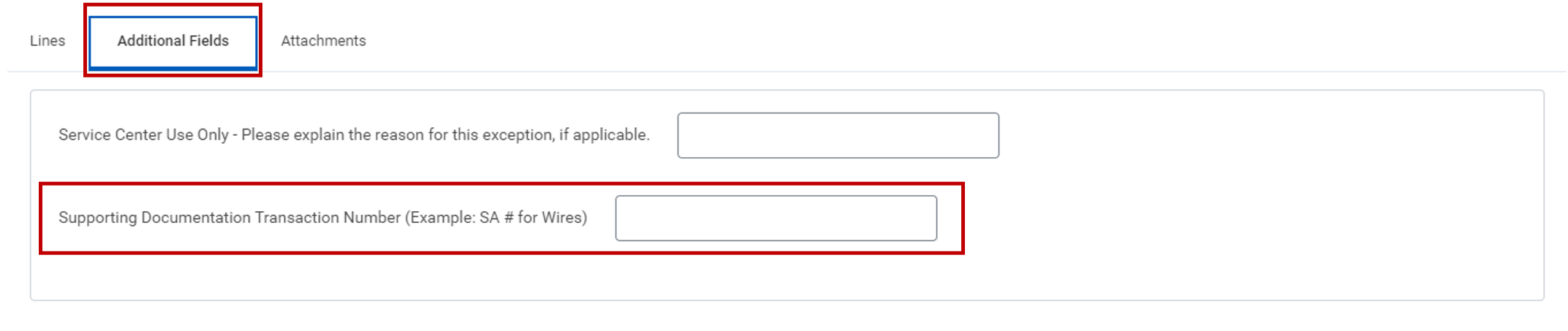

SIR “Additional Fields” Tab

- Please add the SA# in the “Supporting Documentation Transaction Number (Example SA# for Wire)” field if the SIR is for a travel reimbursement. Please add the SA# even if paying with a check.

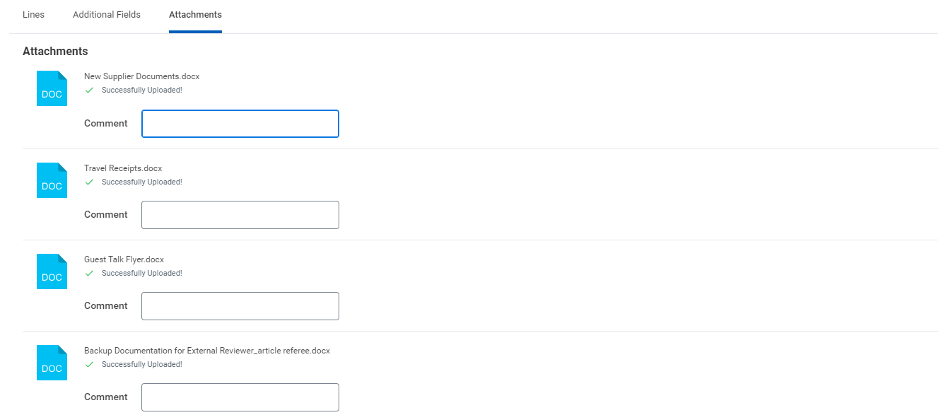

SIR “Attachments” Tab

- All new supplier paperwork, travel receipts, bank information if paying via a wire, invoice or equivalent documentation must be attached.

SIR “Comments” Section

- Please add all relevant information including if payment will be a wire in this section.

What is Sprintax Calculus?

The NRA guest will be contacted via email to create an account with Sprintax Calculus. This determines how much, if any, tax must be withheld from payments from OSU. Below is a sample email the guest will receive.

SIR Job Aid, Worksheet and Sample Communication to the NRA Guest

Per Diem Journal for SIR Submissions (Updated 1/13/26):

Background

All DocuSign PCard Forms that support the issuance of a new PCard or adjustments to an existing PCard will be moved from DocuSign to Workday on Monday, August 12.

Additional information and resources will be posted at the PCard webpage on the Business and Finance site prior to the transition. The PCard Office also offered an Information Session and Demonstration of the new Workday forms and submission process. See the article at the PCard webpage for a link to the recorded session.

ASC Guidelines will not repeat what’s available on the PCard webpage. Please see the PCard webpage for resources on: Card Types, Uses & Limits, Applying for a New PCard, Changing an Existing PCard, Roles and Responsibilities, Training and Job Aids, Transaction Disputes, Lost, Stolen, or Fraudulently Used Cards, Reports & Resources.

For questions, contact the PCard Office at pcard@osu.edu or 614-292-9290. This post is also available via NewsLink online.

ASC Guidelines

General Process

In general, PCard requests should be submitted by the PCard Manager/holder directly. Legally, the PCard Manager must submit new PCard requests. Workday PCard request forms will route to the Cost Center Manager for approval before routing to the Senior Fiscal Officer and PCard Office. If Cost Centers have unique workflow process requirements (e.g. Department Leader), the Cost Center Manager can add an approver ad hoc to workflow for additional approval before the request workflows to the Senior Fiscal Officer.

New PCard Requests and Verification of Training Requirements

Individuals requesting PCards must use the Workday PCard form attachment feature to upload documentation from BuckeyeLearn demonstrating they’ve completed the following trainings:

- Fiscal Stewardship for All

- Preventing Fraud

- PCard Use and Responsibilities

- PCard Overview

This documentation will allow the Cost Center Manager to verify requestors have completed the required training before approving requests.

FAQ

Q: What do I do if a PCard request workflows to me from a cost center outside of ASC?

Unfortunately, Workday doesn’t have the functionality to workflow PCard requests based on the Cost Center field, it doesn’t have the same framework as other requests (e.g., Expense Reports).

If a CCM receives a PCard request for another cost center, they need to add the SFO for that Cost Center for approval. That SFO’s approval will be considered the official SFO approval. To identify the correct SFO for a cost center, the CCM needs to access the Access Role: Role Assignments for Worker Position report and filter the “Group / Role Name” column for “Senior Fiscal Officer” and then locate the correct Cost Center for the request.

PCard nomenclature

Please use the following university required nomenclature when requesting new PCards:

Individual PCard

First & Last Name – 24-character limit

E.g., “Jake Weber”

Department PCard

Unit/Area Name – 24-character limit

E.g., “PCard Office 1”

Service Center PCard

“SC-“Unit/Area Name – 24-character limit

E.g., “SC- PCard Office 1

GET PCard

First & Last Name – 24-character limit

E.g., “Jake Weber”

Alcohol and Event Guidelines

There is always risk whenever alcohol is provided at an event, and therefore, we ask that all events within Arts and Sciences refrain from serving or reimbursing for alcohol when students are among the primary participants or focus of the event. In events where students are present, the event should be managed with due care to ensure the safety of all persons attending and the public. Because staff (including student employees) and faculty members through their employment relationship are representatives of the university and the college, they are expected to uphold the standards and policy promulgated by university in its policies (Drug-Free Workplace Policy 7.30, Expenditures Policy #4.11, and Chapter 3335-23 Code of Student Conduct) and the college in its procedures in hosting and/or attending college sponsored events. Events are a sponsored event if the resources (materials, time, systems) of the college or university are used and communications have the name, logo or identifying marks of the college or university.

The university has specific guidelines regarding alcohol for events held on University property. These guidelines should be reviewed before planning an event.

Prior approval from the Office of Business and Finance must be obtained if alcohol is to be served at a university event in a non-permanently licensed campus location, e.g., atrium, conference room. To arrange for such approval, a request must be submitted to the college office at least four (4) weeks before scheduling the event.

The “Authorization to serve alcohol” request form and instructions may be found here.

Alcohol may not be served at the event until the department receives written B&F approval. Approval should not be assumed.

Procedure for requesting permission to purchase alcohol off campus, such as at departmental holiday parties held off campus, require prior approval- even if at a personal residence. While the Authorization to Serve Alcohol form is not needed for this instance, because there will be alcohol served at someone’s home, the University’s Risk Management team would want to ensure that there are certain items in place to reduce the university’s liability. Number one being that the homeowner’s insurance can cover the event, and if not, that a rider be added for coverage. That along with the documented safety procedures that would be in place need to be approved by Risk Management.

Business meals at off campus locations (restaurants) do not require prior approval, but reimbursement will not be made if it does not comply with the University reimbursement policy (See, Expenditures Policy #4.11).

- Alcohol purchases must be justified for business-related purposes, e.g., business meals or university events.

- Alcohol purchases must be charged to discretionary funds and include the alcohol spend category and commodity code. Conference (earnings) funds may also be used if the reception, meal, or similar event is included in the registration fee paid by the attendee.

- Alcoholic beverages CANNOT be charged to sponsored projects.

- Amounts expended for the purchase of alcohol must not exceed $25 per person (excluding tax and tip). Spending in excess of the per person limit could result in not being reimbursed the overage amount or being required to reimburse the University if a PCard was the method of payment and the exception to policy is not approved by the dean.

- Alcohol expense is approved for dinner only, not for lunch meals.

- The number of invitees to a business meal should be kept to a reasonably justified minimum. As a guideline, five to seven (5-7) participants plus the guest should be the maximum. Additional attendees may be approved as an exception with documented support and approval by the dean.

Department Leaders, Cost Center Managers and PCard Managers are responsible for broadly distributing and establishing a culture of adherence to the University Expenditures Policy.

Cost Center Managers for each unit are responsible for ensuring requests adhere to policy and are within available unit budgets. This includes all transaction types i.e., PCard, reimbursement requests.

- Alcohol Procedure

- The purchase of alcohol in connection with university business is discouraged. If alcohol is considered necessary, due care must be exercised.

- Alcohol can only be charged to discretionary funds. Alcohol may be purchased with funds from an earnings conference fund, if the reception, meal, or similar event at which the alcohol will be served is included in the registration fee paid by the attendees.

- Alcohol purchases must have documented approval in Workday of a unit leader, chief administrative officer, or senior fiscal officer. Per the ASC Delegation of Signature Authority, the unit’s assigned Finance Manager will provide the documented approval in Workday once the transaction is submitted. Cost Center Managers approving the transaction via Workday for the unit must click “Add Approver” and select their Finance Manager by searching for their name. The Finance Manager will review and approve. The ASC Business Services Center will ensure compliance with university policy when processing transactions.

- Amounts expended for the purchase of alcohol is limited to $25 per person, excluding taxes and tip.

- Alcohol purchased for resale by areas with liquor permits (e.g., Blackwell Inn, Fawcett Center, golf course, unions) or for medical or research use is not subject to the above requirements.

These guidelines apply to employee recognition events throughout the year and to celebrations over the holidays.

Office of the President Faculty and Staff Appreciation Guidance

Travel Policy

The objective of the Travel Policy is to ensure efficiency and fiscal accountability for university business travel.

The university will pay for reasonable and necessary expenses incurred for authorized business travel.

Find and View Spend Authorization

Edit or Change Spend Authorization

Cancel or Close Spend Authorization

General Information

- All travel requires an approved Spend Authorization(SA#) in WorkDay prior to departure.

- All travel expenses paid with university funds must comply with the University’s Expenditures, PCard, Internal Controls, Purchasing, and Human Resources policies.

- Travelers need to familiarize themselves with the travel policy prior to making travel arrangements.

- Travelers need to work with travel arrangers or cost center managers to make sure his/her travel plans meet the travel policy requirements.

- Travel arrangers/business managers need to be proactive and ask questions regarding travel plans in advance of departure.

- Policy exceptions are to be occasional and non-recurring. Multiple infractions may prompt loss of partial or full reimbursement.

Approvals

Establish an SA# prior to departure and use of Ohio State payment methods for travel expenses (airfare, registration, etc).

Personal Travel in Conjunction with Business Travel

- Ohio State will only pay/reimburse expenses incurred at locations/times specific to the business purpose.

- Ohio State will not prepay any personal expenses unless documentation verifies there is no increase in cost.

- Cost variances in expenses such as airfare, car rental and lodging must be clearly documented.

University Travel Comparison Worksheet

OSU Travel Cost Comparison Guide

*ASC Travel Comparison Form effective for travel starting January 1, 2026:

Third-Party Payments

Prepayments are not allowed if there will be payment of expenses or reimbursement to the traveler by a third party.

Cash Advance

A cash advance may be issued to a traveler when expenses would cause a financial hardship. Review the Travel Policy for examples of allowable circumstances and additional policy requirements (link below).

Cash advance reconciliation must be reconciled with an expense report in Workday.

Foreign currency should be substantiated by credit card statement or currency conversion if cash was used.

Ohio State contracted agencies are required for Ohio State employees and guests.

University travelers should incur the lowest reasonable rental car expenses that meet the business needs.

- Contracted Rental Car Agency: DW/CDW/LDW and liability insurance is included.

The university contracted suppliers for vehicle rental services include: Enterprise Rent-A-Car, National Car Rental and Hertz Car Rental.

Toll Free Numbers for reservations:

Enterprise: 800-261-7331

National: 877-222-9058

Hertz: 800-704-4473

- Non-Contracted Agency: Purchase of the DW/CDW/LDW and liability insurance is required as personal insurance coverage is not sufficient in providing the coverage listed above.

Failure to purchase the required insurance coverage is a policy violation requiring college-level exception approval. If the exception is denied, the traveler may only receive partial or no reimbursement or be required to reimburse the cost to the university in the case where a procurement card was used as method of purchase.

A screen shot is required showing contracted agencies were not available.

Under no circumstances is PAI (Personal Accident Insurance) or RAP (Roadside Assistance Protection) ever reimbursable.

GPS payment /reimbursement is at the discretion of the department on UNIV funds, but unallowable on OSP grant funding.

For all rental car purchases you must provide the following items in order to be reimbursed:

- Original, itemized receipts

- Fully executed rental agreement signed by traveler indicating DW/CDW/LDW and Liability insurance was purchased (must include the cost, dates and travel locations).

- When a rental car is uses as the principle mode of transportation, justification is required to demonstrate that the automobile is more economical than any other type of transportation.

- Your departmental travel arranger must reinforce these guidelines to you as you plan your trip or if you are hosting a visitor. All visitors should be made aware of these guidelines and they should take advantage of the Ohio State contracts with Enterprise, National and Hertz.

The objective of the Travel Policy is to ensure efficiency and fiscal accountability for university business travel. The University will pay for reasonable and necessary expenses incurred for authorized business travel.

Reimbursements

Reimbursement of travel expenses must be supported by original, itemized receipts where required.

Personal funds used must be submitted in Workday for reimbursement within 60 days of the expense being paid or incurred per the Ohio State policy.

The traveler must submit a request for reimbursement with supporting documentation within 60 days of the return date in Workday. Travel Arrangers should work with travelers to ensure they comply with this policy.

Reimbursements that exceed the travel estimate by 20% or more will be reviewed by the cost center manager for approval in Workday.

Cash Advancement Reconciliation

Cash advance expenses must be documented with original, itemized receipts (or equivalent documentation) and must be reconciled within one month of the return date in Workday.

Any cash in excess of approved reimbursable expenses must be returned to the appropriate departmental account or sponsored project within the same one month period.

Third Party Payments

Travel expenses covered by a third party must be documented in Workday.

Record Retention

All required documentation is to be stored in the eTravel system. Original documentation held by the department may be destroyed 60 days after verification the payment has been made.

Policy exceptions are to be occasional and non-recurring. Multiple infractions may prompt loss of partial or full reimbursement.

Departments will continue to arrange travel, and faculty and staff will continue to provide receipts to departmental staff upon their return. Departmental fiscal staff will provide the detailed documentation to the BSC for reimbursement processing. The Cost Center is responsible for:

- Obtain and organize all original itemized receipts and documentation. Verify legitimacy according to University Travel Policy which can be found here.

- Please provide translation of receipts if necessary

- An Expense Report (ER#) is submitted in Workday by the traveler or cost center representative for BSC review and approval.

Refer to Ohio State Travel Website for travel policy info and forms.