FAQs

Workday

In Workday, you can search by using “View Expense Item” or “Extract Expense Items.” You would type those report names in the Workday search bar. Below is a quick guide produced from “Extract Expense Items."

Gift Cards, Gifts and Recognition

OSU Contracted Suppliers

A bid was done for gift cards and incentives, resulting in contracts being awarded to two suppliers – Virtual Incentives and Tango. These contracts are available for university-wide use for digital and physical gift cards. Contract information can be found at the OSU Purchasing's contract book page.

Virtual Incentives should be the primary supplier of gift cards due to an 8% contract discount on virtual gift cards. This includes priority over direct orders from brands such as Amazon. Any Amazon gift cards should be ordered from Virtual Incentives, not Amazon, in order to receive the discount. Users can select from many different brands and products, including Virtual Visa and Amazon.

Cost Center Attestation

The below statement to be added to all transactions when purchasing gift cards and non-cash items.

“Cost Center assumes responsibility to facilitate any required IRS taxable income reporting for employees, students, and/or non-University recipients. Records and documentation will be maintained within the department. Additionally, any items not immediately distributed will be appropriately tracked and inventoried as a control measure.”

The IRS classifies both “gift cards” and “non-cash items” as taxable benefits (“income”).

- Gift Cards: IRS categorizes gift cards as “cash” (income). Gift card value is reportable regardless of dollar amount. Gift Cards are prohibited to be issued in lieu of payment for goods or services. All University goods or services must be purchased only with University-initiated payment methods.

- Non-Cash Items: IRS categorizes non-cash items as a taxable benefit (income) regardless of item and/or cost. Non-cash items provided to employees throughout a calendar year are cumulatively totaled. If an employee exceeds $100 in non-cash value it is reported to the IRS as taxable income. Non-cash items are gifts of personal property with value. Some examples include clothing (i.e. T-Shirts), mugs, portfolios, and umbrellas.

- Uniforms: If apparel is being provided to employees as a “uniform” then departments must consult with the university Tax Office to determine if the clothing item and cost is/isn’t taxable and document the Tax Compliance response accordingly. Refer to the University-Provided Clothing and Uniforms where the Determination of Taxability Form is referenced.

Employees

- Further Information regarding approvals and details can be found in the university Expenditures policy and Policy 3.15, Reward and Recognition which also includes a link to the Employee Achievement Award Reporting Form required for tax compliance when there is a service award.

Student Non-Employees

- Consult with the University Student Financial Aid Office for most current guidance at sfa-scholarships@osu.edu.

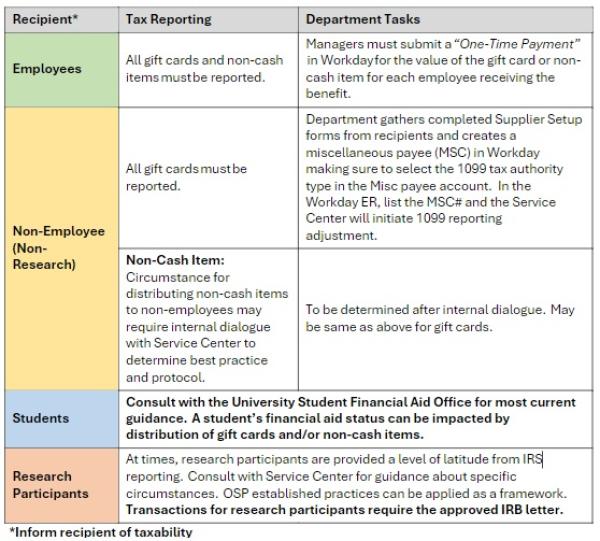

Tax Reporting Tasks and Details

Employees

- The university may offer expressions of acknowledgement/support to its employees in the form of a non-cash item valued at less than $100.

- Acknowledgement may include flowers, a fruit basket, or other non-cash items, and must be coordinated between departments and units to avoid duplication.

- Refer to the guidelines listed in the Expenditures policy.

External Members (e.g. donors)

- The university may pay expenditures relating to entertainment when the purpose is fundraising, promotion of the university, or entertainment for guests of the university by designated university officials. Designated university officials include deans, vice presidents, development officers, senior administrators, and other employees who have been asked to serve in a host capacity.

- ASC limits gifts to donors to $100.

Alcohol

The short answer is always. If a department wishes to serve alcohol at a university event in a non-permanently licensed campus site (such as a holiday party or reception in an atrium or conference room), prior university approval must be obtained. The requirement to gain this permission does not apply to events held at on-campus licensed facilities, such as the Blackwell or the Faculty Club. For more information, review the Alcohol and Other Drugs Policy.

Pre-approval is not necessary to purchase alcohol at licensed facilities, such as off-campus restaurants. Approval may occur either before or after the event.

However, ALL ALCOHOL purchases must receive College approval on the Expense Report in WorkDay. The Cost Center Manager must add the appropriate College Finance Manager for approval.

The amount of alcohol purchased may not exceed $25 per person in attendance.

If the PCard was used for the purchase the cardholder who authorized the purchase will reimburse the college for the overage amount including tip adjustments. If the purchaser is seeking reimbursement, the reimbursable amount will not exceed $25 per person in attendance along with the tax and tip adjustment.

Alcohol may never be charged to general funds or sponsored research projects. Alcohol purchases must be charged to discretionary funds. Adding the College Finance manager in WorkDay on the Expense Report certifies that he fund used is a discretionary fund or an eligible conference(earnings) fund.

Terms & Conditions

No, according OSU Purchasing Policy, “Only the president, senior vice president for business and finance, and individuals given signature authority annually through delegations are authorized to sign contracts on behalf of the university. Failure to ensure that the appropriate signature authority is obtained or executing a contract on behalf of the university without requisite authority may result in personal liability to any employee who executed the contract or was involved in the transaction.”

No, only when the supplier requires a signature and/or has terms and conditions on a special spend categories PCard purchase.

Yes. See the Office of Business and Finance’s Independent Contractor Guidelines for more information.

Yes. Additionally, please consult ASCTech when considering all IT purchases.

The service center staff is in the process of pulling these from OnBase. You can proceed with your purchase.

Please attach the original document, as well as confirmation from the supplier that they don’t need a signature to your Workday transaction.

While we can’t retroactively remove exceptions, we will remove these when we provide monthly and quarterly exception reports.

Incorrect. Terms and conditions on a special spend categories PCard purchases require review and approval.

No, risk is being managed by spend category, regardless of dollar amount.

No, please continue to follow the guidance of OSP and the Grants Shared Services Center.

"University policy applies to any individual involved in approving, making, negotiating, or recommending purchases of goods or services on behalf of the university. Please be aware that when signatures are required only the president, senior vice president for business and finance, and individuals given signature authority annually through delegations are authorized to sign contracts on behalf of the university. Failure to ensure that the appropriate signature authority is obtained or executing a contract on behalf of the university without requisite authority may result in personal liability to any employee who executed the contract or was involved in the transaction.”

- When making purchases, please remember the university’s preferred methods of purchasing (i.e. requisition).

- Please consult ASCTech when considering all IT purchases.

- When in doubt, consult your service center representative.

PCard

Anyone in the department can initiate the request.

Yes. Find a PCard tracking log form here for non-travel and here for travel.

All alcohol transactions and transactions where the cost center Chair/Director are involved will require review by the assigned ASC College Finance Manager. Workday PCard transactions will require the Cost Center Manager to add the appropriate approver.

Yes. There is no limitation on how many vendors or transactions can be submitted on an Expense Report.

Yes.

Yes, create a new expense report with the credit documentation and include the original ER# in the comments.

No. You can only reallocate with OSP funding and GET card.

Travel

Per the OSU Travel Office FAQ "As a business standard, it is generally advisable to allow 1 travel day for domestic and 2 travel days for international on the front end of business travel, while allowing 1 travel day on the back end for both domestic and international travel. However, it may be deemed reasonable by the unit to adjust the amount of travel days if the traveler provides a business justification with the reasoning for the adjustment and the unit approves the business justification in advance of the trip. This documentation should be stored with other travel related documentation in the Spend Authorization (or associated Expense Report) for audit/compliance review."

A pre-approved Spend Authorization (SA) is required for all travel expenditures including mileage for any destination 45 miles or greater from the traveler's headquarters or work location (as defined by HR or flexible work agreement if applicable).

Yes. For duty of care, a Spend Authorization must be submitted. This will also account for any unanticipated expense the third party will not be covering such as ground transportation. Estimated costs being covered by the third party should be listed in the “Justification” of the Spend Authorization. An expense item line must be added to the Spend Authorization such as “Travel Incidentals” for a low dollar amount.

You will create a Travel Expense Report for any reimbursement requests.

All Ohio State employees are required to purchase airfare with the CTP travel agency either through Concur or working with a service agent. Rental cars must be procured via the Ohio State contracted agencies Enterprise, National or Hertz. Group travel (10 or more individuals sharing the exact same itinerary) must be arranged with ScholarTrip travel. To ensure the rental car contract pricing and included required insurance they can be reserved in Concur as well. Please refer to the Travel FAQ for details and links.

Student employees traveling for academic reasons not related to their employment are exempt from the initiative, however it is strongly encouraged for duty of care purposes to use CTP.

Travel exceptions are but are not limited to: lack of pre-approval(After the Fact travel approval/ATF), non-contract rental car procured, lack of rental car insurance purchased, cash advance not reconciled within 30 days of return from trip, reimbursement not submitted by the traveler within 60 days of the travel expense purchase, non-commercial housing was not pre-approved.

The cash advance is reconciled in a Workday Expense Report (ER) which has been linked to the Spend Authorization (SA). The Cost Center will need to contact the BSC Fiscal Lead when there is a deposit for unused fund to repay the cash advance in Workday.

If the contracted agencies are NOT available, or vehicles available do not meet business needs at the time of booking, screen shots need to be pulled at the time of booking and provided to avoid an exception.

If rental car is for domestic travel and is not rented under the contracted agencies, LDW/CDW PLUS liability need to be purchased.

International rental cars rented on contract do NOT include the necessary insurance. Insurance options need to be explored prior to the trip and vetted through Risk Management to ensure coverage is enough to meet The Ohio State University guidelines.

International rental cars rented outside of the contract need to have insurance options vetted through Risk Management.

Learn more about rental car discounts.

You will submit a Supplier Invoice Request (SIR) to process a travel reimbursement for a Non-Resident Alien. A pre-trip Spend Authorization is still required, but the reimbursement will be processed on a Supplier Invoice Request. After the reimbursement has been processed on the SIR and if there are no PCard charges which need expensed on the SA#, please close the Spend Authorization.

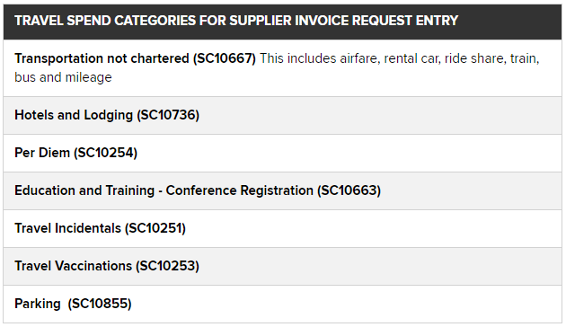

Travel Spend Categories for Supplier Invoice Requests:

Yes. Please make sure you are using the correct Spend Category for each expense.

Per the guidance received from the OSU Travel office, there are two options for this reimbursement:

- Reimburse the traveler and they could then repay their organization.

- Process a Supplier Invoice Request (SIR) for a non-PO invoice. An invoice can be created that lists the organization and travel expenses.

If the SIR process is used, all supplier paperwork will need collected and attached if a new supplier request is needed. This would be submitted and processed like a non-resident alien travel reimbursement. All receipts must be attached and itemized with the appropriate spend category.

Miscellaneous Fiscal Policy FAQ's

Question: Can I be reimbursed for a business purchase I made using rewards from a personal account?

Answer: No. While rewards can be used, Ohio State will not reimburse any purchases made with rewards, etc. Business purchases should follow Ohio State’s Preferred Methods of Purchasing.

Procurement

Business purpose should be written so an individual, unfamiliar to the organization’s operation can understand why the transaction occurred and how it benefits the mission of the University.

Using words such as “for,” “on behalf of,” “at the request of,” etc. help the reader to understand the justification of the transaction or expenditure.

Examples of Poorly Written Business Purposes

- Purchased 50 boxes of granola bars

- Lunch with donor

- Attend ASEE

- Gift card for research participants

- Airfare

- Research collaboration

Examples of Properly Written Business Purposes

- Purchase of granola bars to feed monkeys used in cancer research

- Lunch with donor, Joe Smith, to discuss giving opportunities to the college in support of the building campaign

- Attend American Society of Engineering Educators seminar to present paper on student retention

- Gift cards given to research participants according to protocol

- Invited to University of China to collaborate on chemical refinement processes on behalf of OSU

- Various trips throughout South America to research rural irrigation systems to provide data for journal publication titled “Improving Rural Irrigation Systems”

*Standard office supplies is an acceptable business purpose for typical office supply purchases(i.e. pens, paper, notebooks). However, you do need a specific business purpose for unique office supplies that are not purchased regularly(i.e. DVD player).

Please provide item/catalog numbers along with your item description.

Important: Please provide quote # in the Quote ID box along with an attachment. If you do not have a quote number but an email from vendor then attach that to your requisition. If verbal or web pricing then mention that in Additional Information.

University units that sell goods and services ex: FOD, Tech Hub, The Blackwell, UniPrint, TTM Charter Bus. Some of the Internal suppliers are available in BuckeyeBuy. Examples would include The Blackwell, FOD, UNIV Print, TTM Charter bus. Internal supplies such as Tech Hub, ASC Machine Shop, OCIO, ESL, BuckID, OIA, University Registrar need to be submitted as non-catalog.

It is an online store integrated with Workday, loaded with contracted suppliers for streamlined checkout and approval process. ex: Fisher Scientific, Adriatico’s Pizza, CDWG, etc.

Buckeye Buy order for services often carry over on a Goods line, please do not adjust the cart.

When orders cannot be fulfilled through Internal or BuckeyeBuy supplier.

Purchases made through non-catalog suppliers increase operating costs, delay your purchase, and negate the cost-savings negotiated by purchasing. Orders for non-contracted suppliers often include Terms and Conditions which need to be reviewed by purchasing and countersigned by vendor.

Non-catalog requisitions must use existing suppliers whenever possible. If a new supplier needs to be added to Ohio State's vendor list, it will require additional paperwork and approvals which will further delay the purchase and increase operating costs.

External supplier orders should never be submitted under BuckeyeBuy requisition type.

No. It will not result in a valid BuckeyeBuy requisition.

No. One vendor per requisition.

No. One service line, one chart field.

Updating the name of “Ordering For” would allow the blanket order invoice to workflow to that individual for approval instead of who entered the requisition.

Purchases over $1,000 for external non-contracted vendors.

The quote will allow the procurement staff to compare external pricing to existing contracts to ensure best prices associated with educational discounts offered by suppliers. The quote also provides documentation that can be used during the payment process to ensure that we are billed for the amounts quoted.

A purchase order must be issued prior to the purchase occurring or the purchase is considered an After-the-Fact exception. All After-the-Fact Purchase Orders must follow the Exception policy within the Expenditures policy.

When Internal vendors issue an Internal Service Delivery (ISD) to charge the department, they also close out the PO. This type of PO will not show “paid” but will be closed by the vendor nonetheless.

However, vendors such as The Blackwell, which is listed as external vendor in Workday, will not close purchase orders. In this case, department is responsible for verifying payment and completion of services and asking the BSC procurement associate to close the PO as for any other external vendor.

External vendor contracts over $500,000 should be submitted by the Cost Center Manager to OLA for review and signature. Model Agreements should be signed by your Finance Manager. All other orders under the threshold should be submitted to the BSC for processing. When submitting terms and conditions to the BSC please include supplier contact email.

Bid Waiver: All items that are not on contract and total above bidding limit.

Effective July 1, 2023 UNIV orders for non-contract suppliers for goods and services beyond $75,000 threshold must be submitted with a “Bid Waiver” Requisition Type. Include waiver of competitive bidding and a letter of justification

All purchases, including business meals and alcohol purchases, must include a business purpose justifying the necessity of the expenditure. Purchases involving food and beverage must also include a list of attendees.

What If I don’t know who will be attending?

- If it is a public event, please attach a flyer or announcement. If an invite list is unavailable at the time of the order, please add an audit comment that a list will be kept.

- FOR ALL ORDERS, please comment if any university/college/dept leaders and/or CCM could potentially attend. If they are, please ad hoc for additional approval.

Why do I need to state whether the Chair/Director or CCM will be attending for every request?

- Separation of duty. We need to be able to confirm that appropriate approvals have been received for both the Chair and CCM. We also need to be able to confirm that these approvals are not necessary in the case that they are not attending.

Can the Finance Manager approve for Chair/Director and CCM?

- The college can serve as approver covering both, however it should be clearly stated in the comments they are requesting approval for both attendees to ensure separation of duties.

What is the Catering Marketplace?

- The Buckeye Buy Catering Marketplace is a multi-supplier catalog of drop-off and full-service caterers and event equipment rental suppliers. Menus, discounts, and service details are visible at order entry.

If I have a Quote, do I need to use the Catering Marketplace?

- Yes. Buckeye Buy should be used for contract suppliers.

Do I need a Quote, and do I need to attach it to the requisition?

- Yes. It is best practice to obtain a quote for your event. This will ensure that the vendor is available for the date and time of your event. Purchase orders without prior contact with the supplier may not be filled because of the suppliers existing prior commitments. Additionally, BSC can confirm that you are receiving correct discounts and your event details can be communicated in the PO details.

What if my quote doesn’t match the pricing in the Catering Marketplace?

- A Catering Service line has been added to most of the drop-off service catalogs in the Catering Marketplace. This will allow users to enter a one-line order for event food, beverages, disposables, etc. as quoted by the supplier.

- In the event this is not an option for your vendor of choice, you will need to build a cart listing individual items. If the pricing does not match what is in the Catering Marketplace, then contact your BSC associate for direction.

Full-service catering including alcohol.

- A copy of the itemized quote must be attached for the BSC to verify if there is alcohol, and that the OSU contract pricing is being provided. Alcohol should be separated out.

What are “Area Worktags”? Which one do I use?

Area Worktags are entered into the Additional Worktags column and allow the university to determine if there are non-OSU attendees at your event.

- AR1440 for Internal attendees (Faculty, Staff, Students)

- AR1442 for External attendees (at least one guest is not from OSU)

I don’t see a signature line, why does the Finance Manager need to sign the catering confirmation?

- Confirmations from Internal Catering Suppliers (University Catering, Ohio Union and the Blackwell) request initials or state that by issuing a PO, we agree to be bound by the terms and conditions expressed in this Event Confirmation and the accompanying Facility Policies and Procedures. These are viewed as model agreements and should be submitted via DocuSign for department’s Finance Manager signature.

Order confirmation

- It is the department’s responsibility to follow up with the vendor to confirm the receipt of PO and conformation of delivery.